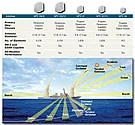

The US Navy’s Dual-Band Radar that equips its forthcoming Gerald R. Ford class super-carriers replaces several different radars with a single back-end. Merging Raytheon’s X-band SPY-3 with Lockheed Martin’s S-band VSR allows fewer radar antennas, faster response time, faster adaptation to new situations, one-step upgrades to the radar suite as a whole, and better utilization of the ship’s power, electronics, and bandwidth.

Rather than using that existing Dual-Band Radar design in new surface combatant ships, however, the “Air and Missile Defense Radar” (AMDR) aims to fulfill DG-51 Flight III destroyer needs through a new competition for a similar dual-band radar. It could end up being a big deal for the winning radar manufacturer, and for the fleet. If, and only if, the technical, power, and weight challenges can be mastered at an affordable price.

AMDR: The Program

Faced with a growing array of advanced threats, the US Navy confronted a need for more dual-band naval radars among its top-end surface warships. Both CG (X) and FSC were proposed for cancellation in the FY 2011 defense budget, but the “Air and Missile Defense Radar” (AMDR) is expected to continue as the radar centerpiece for their true successor: the DDG-51 Flight III Arleigh Burke Class.

Rather than extending or modifying the existing Dual Band Radar combination used on its DDG-1000 Zumwalt Class, aimed to fulfill these need through a re-opened competition. The resulting AMDR radar will have 3 components:

* The AMDR-S radar will provide wide-area volume search, tracking, Ballistic Missile Defense (BMD) discrimination, and missile communications. While top-tier air and missile defense vessels are “blue water” ships by nature, critical naval chokepoints and war scenarios don’t always give commanders a choice. As such AMDR requirements also call for defense against very low observable/very low flyer (VLO/VLF) threats in heavy land, sea, and rain clutter, where S-band has some advantages.

* The AMDR-X radar will provide horizon search, precision tracing, missile communications, and final illumination guidance to targets. It will be available in AMDR sets 13 onward. The first 12 ship sets will use an upgraded version of Northrop Grumman’s in-service SPQ-9B radar instead.

* The back-end Radar Suite Controller (RSC) will perform all coordination, ensuring that the radars work well together.

Design goals explicitly involve hardware and software modularity, future technology, insertion, and open architectures. The limitations of the DDG-51 ship design forced some flexibility all by itself, and the initial specification added that it’s “designed to be scalable to accommodate current and future mission requirements for multiple platforms.”

The 1st DDG 51 Flight III destroyer will be part of the FY 2013 – 2017 multi-year award, beginning with long-lead materials ordered in FY 2015, and built as the 2nd ship ordered in FY 2016 (DDG 123). By the end of the multi-year contract, which was issued in May 2013, the USN can contract for 3 AMDR/Flt III vessels with 14′ diameter AMDR-S radar faceplates, and integrated control involving the smaller rotating AN/SPQ-9B+ X-band radar. If AMDR-S isn’t ready, or other issues arise, the Navy could decide to delay the FLight III changes to FY 2017, or even to move them outside the contract. Even if orders begin on time, Flight III buys are expected to continue trough 2022, and possibly through 2031.

Budget documents to date are all for Research, Development, Testing & Evaluation:

AMDR: Opportunities and Challenges

The demand for adjustable size is the key to AMDR’s larger opportunity. If the adjustments can be taken far enough, it could give the Navy an opportunity to add or retrofit AMDR to some of its 60+ serving Arleigh Burke Class ships, DDG-1000 Zumwalt Class destroyers, or later carriers of the CVN-78 Gerald R. Ford Class.

On the smaller end, it’s very nice to have AMDR capabilities available in a common core system for a wider range of vessels. More ships mounting AMDR would reduce fleet-wide maintenance & training investments. It would also mean that each AMDR hardware or software improvement becomes available improve many more ships throughout the fleet.

At the larger end of the scale, it’s good news because the US Navy has determined that it needs a 20’+ diameter AMDR-S radar, in order to completely fulfill expected future ballistic missile defense and air defense needs. AMDR offers them the opportunity to find a suitable ship based on a known and understood core system.

The bad news is that any retrofit, or even installation in new “DDG-51 Flight III” variants, will be more complicated than it appears.

The visible face of a naval radar is only the tip of the iceberg. Most of its weight and space comes from its need for 2 things: power, and cooling. More powerful radars usually need more power to drive them, which can tax the limited 7.5 MW capacity an older ship like the DDG-51 Flight I/II/IIAs. More power also means more cooling much of the time. Power storage, power conversion, and cooling require weight and space. All of which are usually in short supply on a warship. Even if that space exists, the additional equipment and antennas must be installed without unduly affecting the ship’s balance and center of gravity, and hence its seakeeping abilities.

In 2009, the US Congressional Research Services’ “Navy DDG-1000 and DDG-51 Destroyer Programs: Background, Oversight Issues, and Options for Congress” report update (#RL32109) explained the potential impact:

“Multiple industry sources have briefed CRS on their proposals for modifying the DDG-51 design to include an active-array radar with greater capability than the SPY-1. If the DDG-51 hull is not lengthened, then modifying the DDG-51 design to include an improved radar would require removing the 5-inch gun to make space and weight available for additional equipment needed to support operations with the improved radar. Lengthening the hull might provide enough additional space and weight capacity to permit the 5-inch gun to be retained.75 Supporting equipment to be installed would include an additional electrical generator and additional cooling equipment.76 The best location for the generator might be in one of the ship’s two helicopter hangar spots, which would reduce the ship’s helicopter hangar capacity from two helicopters to one.”

An October 2008 report from the right-wing Heritage Foundation draws on other sources to note that weight shifts can also create issues:

“…SPY-1E [active array] radar could affect the stability of the upgraded Arleigh Burkes because the radar’s phased-array panels weigh more than the panels of the earlier SPY-1 radar, which it will replace. While the SPY-1E’s weight is concentrated more in the panels, freeing more space below deck,[78] this greater weight would be added to the ship’s superstructure. Combined with the DDG-51’s relatively narrow hull width and short length, this could cause stability problems, particularly when sailing in rough weather.”

Obviously, those kinds of trades are less than ideal, but they may be necessary. Whether, how many, and which trades end being necessary, depends on the precise technical details of Raytheon’s offering, and of expected ship changes in Flight III.

AMDR: The Contenders

Raytheon

[youtube:v=yNkUx9vguQ8]

click for video

Raytheon won. They went into AMDR with a lot of experience. First of all, they developed both the existing Dual-Band Radar’s Radar Suite Controller, and the accompanying SPY-3 X-band radars that are mounted on DDG-1000 Zumwalt Class battlecruisers and CVN-78 Ford Class supercarriers. The dual X/S band system that will equip the Cobra Judy (USNS Observation Island) Replacement vessel used to track missile launches and tests around the world also comes from Raytheon.

Phased array radars for wide-area air and ballistic missile defense are another strong point. Raytheon builds the AN/TPY-2 X-band radar used by the land-based THAAD missile system, the 280 foot high X-band array on the floating SBX missile defense radar, and the large land-based ballistic missile Upgraded Early Warning Systems like the AN/FPS-108 Cobra Dane and AN/FPS-115 PAVE PAWS. On the S-band side, the firm builds the S-band transmitters for Lockheed’s SPY-1 radar on board existing American destroyers and cruisers. Unsurprisingly, Raytheon personnel who talked to us said that:

“…leveraging concepts, hardware, algorithms and software from our family of radars provides a level of effectiveness, reliability and affordability to our proposed AMDR solution… The challenge for all the competitors will be to deliver a modular design. The requirements demand that the design be scalable without significant redesign… A high power active radar system requires significant space not only for the arrays themselves but also for the power and cooling equipment needed to support its operation. Finding space for additional generators and HVAC plants can be quite challenging for a backfit application. That is why power efficiency is a premium for these systems.”

Lockheed Martin – lost

[youtube:v=UfMYslk29R0]

click for video

Lockheed Martin stepped into the competition with several strengths to draw on. Their AN/SPY-1 S-band radar is the main radar used by the US Navy’s current high-end ships: DDG-51 Arleigh Burke class destroyers, and CG-47 Ticonderoga class cruisers. Lockheed Martin also makes the AEGIS combat systems that equips these ships, and supplies the advanced VSR S-band radar used in the new Dual Band Radar installations on board Ford class carriers. This strong S-band experience, and status as the supplier of the combat system that any DDG-51 fitting would have to integrate with, gave them leverage at multiple points. Some observers publicly wondered if they had so much leverage that the competition would become a mirage, especially since the US Navy insisted on keeping AEGIS as the combat system.

Nor were they devoid of X-band or ballistic missile defense experience. Their L-Band AN/TPS-59 long range radar has been used in missile intercept tests, and is the only long range 3D Radar in the Marine Air-Ground Task Force. It’s related to the AN/TPS-117, which is in widespread service with over 16 countries. Then, too, the firm’s MEADS air defense technology demonstrator’s MFCR radar will integrate an active array dual-band set of X-band and UHF modules, via a common processor for data and signal processing.

It was a strong array of advantages. In the end, however, it wasn’t enough.

Northrop Grumman – lost

[youtube:v=iuuRszQoIdY]

click for video

Northrop Grumman was a less obvious contender, despite its leadership position in advanced AESA active array radars for use on aircraft of all types and sizes. They’ve also developed unique software-driven land-based systems like the US Marines’ new Ground/Air Task Oriented Radar (G/ATOR), which is specifically architected to switch between a wide range of radar performance modes and requirements.

It’s important to note that Northrop Grumman has shipboard radar experience. They’re the prime contractor for the AN/SPQ-9B track-while-scan X-band radar that’s guaranteed to be part of the initial AMDR set, and SPQ-9A/B radars already equip America’s Ticonderoga Class cruisers, Nimitz Class aircraft carriers, America Class escort carriers, Wasp Class LHD amphibs, and San Antonio Class LPD amphibs. AN/SPQ-9Bs can also be found on Australia’s Hobart Class Aegis air warfare destroyers.

On a less visible note, the firm has been working under several CRAD research programs from 2005 to the present, targeted at technology demonstrations, system risk reduction, and new integration techniques for advanced S-band shipboard radars. Finally, the firm has a partnership with Australia’s CEA Technologies, which is developing an advanced AESA X-band (CEAMOUNT) and S-band (CEAFAR) radar set that equips Australia’s upgraded ANZAC class frigates.

What did this team see as important? Beyond an open architecture approach, it was all about the SWaP:

“The ability to scale up to a potential future cruiser or down to a DDG-51 variant is fundamental to the Northrop Grumman radar architecture. Size, weight and power (SWaP) of the radar system are the key drivers… Minimizing the radar impact is key to an affordable surface combatant solution. We are focused on not just the radar technology, but to minimize the ship impact while allowing for scalable growth in the future. We are working closely with various elements in the Navy to address the ship impact of large AESA radars on the entire ship.”

AMDR: Contracts and Key Events

FY 2019-Today

Raytheon wins EMD phase; DRS will produce power conversion module; CRS and GAO reports point out issues.

[youtube:v=616guIzmyGw]

click for video

October 3/22: Sustainment Material The Navy awarded Raytheon a $16 million contract modification for sustainment material and support for the AN/SPY-6(V) family of radars. The solid state, fixed-face and rotating SPY-6 variants provide integrated air and missile defense capabilities. Work will take place ein California, Arizona, Massachusetts and Virginia. Expected completion will be by September 2023.

February 15/21: USS Jack H. Lucas Work to integrate the AN/SPY-6 radar on the new Aegis Flight III guided-missile destroyer, the future USS Jack H. Lucas (DDG 125), has started. Installation is being carried out at the Huntington Ingalls Industries shipyard in Pascagoula, Mississippi. “As the future USS Jack Lucas takes shape, we are at the cusp of a new era for detection and discrimination of threats and decision-making at sea,” said Capt. Jason Hall, program manager for Above-Water Sensors for the US Navy’s Program Executive Office for Integrated Warfare Systems. “SPY-6 will fill critical mission gaps and enable precision operations in jammed and cluttered environments like never before.”

July 23/19: Adjustment Raytheon won a $27.4 million incentive-fee modification to settle a request for equitable adjustment for contractor provision of Air and Missile Defense Radar (AMDR) program Pacific Missile Range Facility site generators and associated support hardware. The deal resulted from a government change order. The contract includes engineering and manufacturing development (EMD), as well as options for up to nine low-rate initial production shipsets. The AMDR program is an ACAT IC acquisition program in the Production and Deployment Phase. In June 2009, after full and open competition, the program awarded three AMDR-S/RSC concept study contracts to Lockheed Martin, Raytheon and Northrop Grumman. Each of the three contractors developed concepts for AMDR showing the major subsystems and expected features of the AMDR Suite. Raytheon’s AN/SPY-6(V) is the US Navy’s next generation integrated air and missile defense radar. The modification increases the value of the AMDR EMD phase to account for new scope directing the contractor to provide Pacific Missile Range Facility site generators and support. Work took place in Massachusetts and Hawaii and was finished in June 2018.

July 18/19: Production Raytheon won a $40.2 million modification to produce two AN/SPY-6(V) configuration variants – the SPY-6(V)2 Rotator Radar and the SPY-6(V)3 Fixed Face Radar. The AN/SPY-6(V) is an active electronically scanned array air and missile defense radar. The Navy’s next generation radar system will address Ballistic Missile Defense (BMD) and Air Defense capability gaps identified in the Maritime Air and Missile Defense of Joint Forces Initial Capabilities Document. AN/SPY-6(V)1 provides surface combatants with the Joint Battlespace Threat Awareness and Defense capability to counter current and future threats in support of joint forces ashore and afloat, providing the combat system with simultaneous sensor support of the IAMD mission with ancillary support of Surface Warfare missions. The single-face rotating array designated AN/SPY-6(V)2 variant is for amphibious assault ships and Nimitz Class carriers. The three fixed-face array designated AN/SPY-6(V)3 variant is for Ford Class aircraft carriers and the future FFG(X) guided missile frigates. Raytheon will perform work in Marlborough, Massachusetts and is scheduled to be finished by June 2020.

April 24/19: Integration and Production The Navy awarded Raytheon a $28 million contract modification for integration and production support for the Air and Missile Defense Radar AN/SPY-6(V). The AN/SPY-6(V) next-generation integrated radar will be featured on the Flight III Arleigh Burke Guided Missiles Destroyers. According to Raytheon, the SPY-6 is built with so called Radar Modular Assemblies, each of them a self-contained radar in a 2’x2’x2’ box. They can stack together to form any size array to fit the mission requirements of any ship, which would make the SPY-6 the Navy’s first truly scalable radar. In January, the radar completed an important milestone when it successfully tracked a ballistic missile target in the system’s final development test. The radar is on schedule for delivery to the Navy in 2020, replacing the SPY-1 radar. The contract includes support for continued combat system integration and testing, engineering, training, software and depot maintenance as well as field engineering services. Raytheon will perform work at various locations within the US. The estimated completion date is in December this year.

March 21/19: New Generation Raytheon’s Enterprise Air Surveillance Radar (EASR) will begin live testing at Wallops Island Test Facility, the company announced on Tuesday. The EASR is the newest sensor in the US Navy’s SPY-6 family of radars. It is the Navy’s next generation radar for aircraft carriers and amphibious warfare that provides simultaneous anti-air and anti-surface warfare, electronic protection and air traffic control capabilities. The radar just recently completed subsystem testing at Raytheon’s Near Field Range in Sudbury, Massachusetts. Raytheon is building two variants of EASR: a single-face rotating array designated AN/SPY-6(V)2 for amphibious assault ships and Nimitz class carriers, and a three fixed-face array designated AN/SPY-6(V)3 for Ford class aircraft carriers and the future FFG(X) guided missile frigates. According to Raytheon, the radar will undergo system-level testing, tracking a variety of aircraft through the end of 2019 once it is up and running.

March 18/19: LRIP The US Navy awarded Raytheon a $402.7 million contract modification for the Air and Missile Defense Radar (AMDR) Program low-rate initial production (LRIP). Raytheon will build three advanced-prototype versions of the new AN/SPY-6(V) Air and Missile Defense Radar for Arleigh-Burke Class (DDG 51) Aegis Destroyers. LRIP means building small quantities of the system to enable Navy experts to test it thoroughly, ensuring it meets Navy requirements. It is the first step to switch from customized hand-built prototypes to the final mass-produced end product. The AMDR aims to fulfill DDG 51 Flight III destroyer needs through a new competition for a dual-band radar. According to Raytheon, the AN/SPY-6(V) AMDR will improve the Burke Class destroyer’s ability to detect hostile aircraft, surface ships, and ballistic missiles. Work will take place in Marlborough, Massachusetts and is scheduled to be completed by March 2023.

FY 2018

December 21/18: Integration & Production Raytheon is being contracted to support the US Navy with Air and Missile Defense Radar (AMDR) integration and production efforts. Priced at $114 million, the contract provides for continued combat system integration and test services including engineering and training; software and depot maintenance, as well as field engineering services and procurement of spare parts. The AMDR, designated AN/SPY-6(V), will fulfill integrated Air and Missile Defense requirements for multiple ship classes. The AN/SPY-6 is 30 times more sensitive than its predecessor, its additional sensitivity supercharges the vessel’s capabilities in anti-air warfare and ballistic missile defense. Work will be performed at multiple locations throughout the US. They include Marlborough, Massachusetts; Kauai, Hawaii; Portsmouth, Rhode Island; San Diego, California; Fair Lakes, Virginia and Moorestown, New Jersey. The contract includes options which could bring the total value of the order to $357 million and is expected to be completed by December 2019.

December 11/18: Power Units DRS Power & Control Technologies is receiving additional funding to exercise an option to support the Navy’s Arleigh Burke-class destroyers. The contract modification is priced at $13.4 million and provides for the delivery of power conversion modules (PCM) for Air and Missile Defense Radar (AMDR) production ship sets. Efforts covered under this contract include non-recurring engineering work, procurement of long-lead-time materials and of low-rate initial production units for testing. Up to 12 ship sets for the guided missile destroyers can be procured. PCMs support Raytheon’s AN/SPY-6 air and missile defense radar with the right power output. This contract supports DDG-51 Flight III ships. Work will be performed in Milwaukee, Wisconsin, and is expected to be complete by April 2022.

October 3/18: LRIP continues The US Navy is ordering more production services for its Air and Missile Defense Radar from Raytheon. The awarded cost-plus-fixed-fee modification covers a number of engineering services and associated costs needed to support the low-rate initial production of the AN/SPY-6 at cost of $22.7 million. The new AMDR is being developed to fulfill integrated Air and Missile Defense requirements for multiple ship classes. The AMDR-S radar will provide wide-area volume search, tracking, Ballistic Missile Defense (BMD) discrimination, and missile communications; while the AMDR-X will provide horizon search, precision tracing, missile communications, and final illumination guidance to targets. It will equip various types of vessels such as DDG-51s in Flight III configuration and Gerald F. Ford-class aircraft carriers. Work will be performed at Raytheon’s Marlborough facility and is expected to be completed by November 2018.

May 15/18: Navy gets an extra punch Shipbuilder Huntington Ingalls recently announced that the first steps towards constructing the first Flight III Destroyer have been taken. The destroyer ‘Jack Lucas’ will join the Navy’s fleet in 2024. The vessel is modelled after the 73 Arleigh-Burke class destroyers already in service, but it will be a very different, more capable killer than its predecessors. ‘Jack Lucas’ gets its extra punch by adding Raytheon’s newly developed AN/SPY-6 air and missile defense radar. The Flight III is a major overhaul of the guided-missile destroyer. It required a 45 percent redesign of the hull, most of which was done to accommodate the AN/SPY-6 and its formidable power needs. The Air and Missile Defense Radar (AMDR) has been procured through a competition between Raytheon, Lockheed Martin and Northrop Grumman. The AMDR-S provides wide-area volume search, tracking, Ballistic Missile Defense discrimination, missile communications and defense against very low observable and very low flyer threats in heavy land, sea, and rain clutter. In addition, the AMDR-X provides horizon search, precision tracing, missile communications, and final illumination guidance to targets. The AN/SPY-6 is 30 times more sensitive than its predecessor, its additional sensitivity supercharges the vessel’s capabilities in anti-air warfare and ballistic missile defense.

FY 2014

Sept 11/14: Sub-contractors. DRS Power & Control Technologies, Inc., Milwaukee, Wisconsin, is being awarded a base $15.7 million firm-fixed-price, time-and-materials contract for DDG 51 Class Power Conversion Modules (PCM) to support AMDR with the right kind of power input. This contract provides for AMDR PCM non-recurring engineering, long-lead-time material buys, low rate initial production units for testing, associated engineering services and support, and up to 12 production ship sets for DDG 51 Flight III Class ships. Just $2.4 million in FY 2014 US Navy RDT&E funding is committed immediately, but options could bring the cumulative value of this contract to $88.9 million.

Work will be performed in Milwaukee, WI, and is expected to be complete by April 2015. This contract was competitively procured using full and open competitive procedures, with proposals solicited via FBO.gov, and 4 offers were received by contract manager US Navy NAVSEA in Washington, DC (N00024-14-C-4200).

July 23/14: Testing. Raytheon announces that their AMDR radar has completed its hardware Preliminary Design Review and Integrated Baseline Review. They look at the capabilities of the system, removal of technology risks so far, and the inherent innovation and flexibility of the design.

Successful completion keeps the program on schedule so far, but remember that this schedule has changed due to challenge delays, and that ship integration issues will present their own hurdle. Sources: Raytheon, “Raytheon completes key Air & Missile Defense Radar reviews”.

April 17/14: SAR. The Pentagon releases its Dec 31/13 Selected Acquisitions Report. AMDR enters the SAR with a baseline total program cost estimate of $5.8327 billion, based on 22 radars.

SAR baseline

April 8/14: CRS Report. The latest iteration of “Navy DDG-51 and DDG-1000 Destroyer Programs: Background and Issues for Congress” offers a greater focus on the DDG-51 Flight III destroyers, which includes AMDR. Note that CRS reports aren’t made public directly, so it took until May 2014 for public copies to appear.

One big issue for AMDR is capability. The 14′ design expected on Flight III destroyers meets the US Navy’s minimum expectations for missile and air defense roles, but there’s some question whether it will be enough. CRS’ report includes the concept of a dedicated radar ship to augment task groups in high-risk areas. The other option?

“Building the Flight III DDG-51 to a lengthened configuration could make room for additional power-generation and cooling equipment, additional vertical launch system (VLS) missile tubes, and larger growth margins. It might also permit a redesign of the deckhouse to support a larger and more capable version of the AMDR than the 14-foot diameter version currently planned for the Flight III DDG-51. Building the Flight III DDG-51 to a lengthened configuration would increase its development cost and its unit procurement cost.”

There’s also some concern about AMDR’s timeline, and whether the 1st AMDR-S can be fully ready in time to support a ship ordered in FY 2016. AMDR-S entered system development 6 months late due to protests, and software development to integrate both the new S-band radar and the X-band SPQ-9B+ remains a concern (q.v. March 28/13). Ship power generation and cooling could also be an issue, depending on the final design. The good news? Because the Flight III is structured as an optional ECP change within a multi-year contract, the Navy can choose to delay issuing the ECP, shifting the start of Flight III procurement and AMDR orders to FY 2017 or later.

March 31/14: GAO Report. The US GAO tables its “Assessments of Selected Weapon Programs“. Which is actually a review for 2013, plus time to compile and publish.

“AMDR entered system development in October of 2013 with all four of its critical technologies approaching full maturity. This was 6 months later than planned, leading to a delay in many of the program’s future events…. Additionally, the delays might also hinder timely delivery of necessary information related to AMDR’s parameters, such as power, cooling, and space requirements needed for ongoing and planned design studies related to [DDG-51 destroyer] Flight III development.”

Despite this, the program is still promising delivery in time for a 2019 fit onto DDG 123. GAO describes AMDR’s components as almost mature, including 2 key technologies. With that said, they’re unhappy that AMDR proceeded to EMD development without fully mature technologies demonstrated in an operational environment, so the program would have a better idea of the required form, fit, and changes to its host ship. AMDR also didn’t complete a Preliminary Design Review before EMD, either, though they did have the competition and evaluations:

“All four of the AMDR’s critical technologies are approaching full maturity and were demonstrated using a [small scale] 1000-element radar array…. two technologies previously identified as the most challenging — digital-beam-forming and transmit-receive modules, have been demonstrated in a relevant environment…. digital-beam-forming is necessary for AMDR’s simultaneous air and ballistic missile defense mission. The AMDR’s transmit-receive modules… use gallium nitride [GaN] technology instead of the legacy gallium arsenide technology for potential efficiency gains. The other two critical technologies are related to software and digital receivers and exciters. Officials stated that software development will require a significant effort. A series of software builds are expected to deliver approximately 1 million lines of code and are designed to apply open system approaches to commercial, off-the-shelf hardware. Integrating the X-band radar will require further software development.”

Feb 25/14: Sub-contractors. General Dynamics Advanced Information Systems announces an contract to continue their AMDR-related with Raytheon. The sub-contract could be worth up to $250.1 million over 10 years, and builds on previous GD-AIS efforts involving AMDR-S Digital Receivers/Exciter (DREX) and Digital Beam Forming (DBF) subsystems. Sources: GD, “General Dynamics Awarded $250 Million Contract to Support U.S. Navy’s Air and Missile Defense Radar Program”.

Jan 10/14: Protest dropped. Defense News:

“Lockheed Martin protested the Navy’s award of the Air and Missile Defense Radar (AMDR) contract because we believed the merits of our offering were not properly considered during the evaluation process,” spokesman Keith Little said Jan. 10. “While we believe that we put forward an industry-leading solution, after receiving additional information we have determined it’s in the best interest of the Navy and Lockheed Martin to withdraw our protest.”

The move still leaves Lockheed Martin in charge of the Aegis combat system. Raytheon, who had been responsible for delivering SPY-1 radar transmitters to Lockheed, is now responsible for the entire AMDR S-band radar and dual-band controller, while Northrop Grumman’s AN/SPQ-9B acts as the initial X-band radar. Sources: Defense News, “Lockheed Drops AMDR Protest”.

Oct 22/13: Protest. Lockheed Martin filed a protest with the Government Accountability Office (GAO), arguing that they “submitted a technically compliant solution at a very affordable price. We do not believe the merits of our offering were properly considered during the evaluation process.” Lawmakers from New Jersey, where Lockheed Martin Mission Systems and Sensors is located, had sent a letter to the Navy Secretary a few days ago criticizing the award to Raytheon. The Navy subsequently issues a stop-work order, while the GAO has until the end of January 2014 to give its verdict.

Oct 10/13: EMD. Raytheon Company announces that they’ve won, receiving a $385.7 million cost-plus-incentive-fee contract for the AMDR-S and Radar Suite Controller’s (RSC) Engineering and Manufacturing Development (EMD) phase.

The base $157 million contract begins with design work leading to Preliminary Design Review, and will finish with system acceptance of the AMDR-S and RSC engineering development models at the end of testing. AMDR-S is the large S-band radar, while the RSC provides S- and X-band radar resource management, coordination, and an interface to Lockheed Martin’s Aegis combat system. The full contract would produce initial ship sets that will work with Northrop Grumman’s AN/SPQ-9B as their X-band counterpart.

This contract also includes options for low-rate initial production systems, which could bring the cumulative value to $1.6 billion. These options would be exercised after a successful Milestone C decision, which the Pentagon plans to make in FY 2017. Sources: Raytheon, Oct 10/13 release.

Raytheon wins EMD contract

Oct 18/13: CBO Report. The Congressional Budget Office publishes “An Analysis of the Navy’s Fiscal Year 2014 Shipbuilding Plan“. With respect to AMDR:

“Adding the AMDR [to the DDG-51 design] so that it could operate effectively would require increasing the amount of electrical power and cooling available on a Flight III. With those changes and associated increases in the ship’s displacement, a DDG-51 Flight III destroyer would cost about $300 million, or about 20 percent, more than a new Flight IIA destroyer, CBO estimates. Thus, the average cost per ship [for Flight III DDG-51s] would be $1.9 billion…. Most of the decrease for the Flight III can be attributed to updated information on the cost of incorporating the AMDR into the Flight III configuration. The cost of the AMDR itself, according to the Navy, has declined steadily through the development program, and the Department of Defense’s Cost Analysis and Program Evaluation (CAPE) office concurs in the reduced estimate…. Considerable uncertainty remains in the DDG-51 Flight III program, however.”

FY 2013

Major program shifts.

June 3/13: NAVSEA Clarifications. NAVSEA replies to some of our program questions, and clarifies the program’s structure. They clarifiy the GAO’s wording concerning “AMDR initially using an upgraded SPQ-9B radar,” by saying that the initial SPQ-9Bs will be off-the-shelf models, acquired under a separate program. SPQ-9A/B radars already equip America’s Ticonderoga Class cruisers, Nimitz Class aircraft carriers, America Class escort carriers, Wasp Class LHD amphibs, and San Antonio Class LPD amphibs.

The SPQ-9B will still be integrated with AMDR-S, but there are some differences in implementation between it and AMDR-X, hence the additional software required. The result will effectively create DDG-51 FLight III and Flight IIIA ships, as the Navy has no plans to backfit AMDR-X to Flight III ships that get the SPQ-9B.

The remaining question is when a winner will be picked. The GAO said (q.v. March 28/13) that an EMD winner and development award was expected in March 2013, and we’re past that. All NAVSEA would say is that the AMDR program office is still conducting evaluations. They also said that AMDR-X’s acquisition strategy isn’t set yet, which leaves the door open to a divided radar contract.

May 8/13: The US Senate Armed Forces Seapower subcommittee hears testimony [PDF] regarding US Navy shipbuilding programs. An excerpt:

“The Navy is proceeding with the Air and Missile Defense Radar (AMDR) program to meet the growing ballistic missile threat by greatly improving radar sensitivity and longer range detection for engagement of increasingly complex threats. This scalable radar is on track for installation on DDG 51 Flight III ships to support joint battle space threat awareness and defense, including BMD, area air defense, and ship self defense. The AMDR radar suite will be capable of providing simultaneous surveillance and engagement support for long range BMD and area air defense. The Navy intends to introduce AMDR on DDG 51 Flight III in Fiscal Year 2016.”

GAO documents have referred to AMDR’s introduction in FY 2019, but procurement buys will begin in FY 2016.

April 26/13: Real Competition? Aviation Week reports on the AMDR program. Beyond the materials in the GAO’s report, discussions with the US Navy offer cause for concern. They quote AMDR program manager Capt. Doug Small as saying that AMDR will be just an evolution of Aegis, providing better performance for “only slight more” weight, power, and coolant demands, and “a fraction of the resources needed to run all of dual-band radar (DBR) or even existing Aegis SPY radars to conduct similar missions.”

The SPY-3/ SPY-4 DBR comparison seems like a pretty big stretch, given that they haven’t picked their AMDR radar yet, much less tested it. Article author Michael Fabey’s concerns, on the other hand, lie in another area:

“….the Navy will have to take great pains to ensure the competitiveness of the AMDR program. The service can ill afford to have this effort be seen as just an extension of the “Aegis Mafia,” often seen as… the automatic property of Lockheed, the combat system’s creator and prime contractor throughout the decades.”

It’s a real dilemma. Commonality with an existing combat system makes cross-fleet upgrades much easier, while lowering overall maintenance and upgrade costs. In Aegis’ case it also leverages work that has been and will be done on Ballistic Missile Defense modes. On the other hand, Aegis’ existing inter-dependencies with Lockheed’s own SPY-1 design are a stumbling block. Can the Navy really deliver AMDR on budget, while swapping in an S-band radar from another company? If they say yes and it’s not actually doable, AMDR will flounder and may fail. If the Navy decides that they can’t risk it, then the whole AMDR-S competition was a waste of time.

An AMDR-S award to Raytheon might still be thinkable if the Navy goes with the lesser standard of fleet combat system commonality, using the Raytheon combat system that drives the 3-ship DDG-1000 Zumwalt Class, and leveraging Raytheon’s combat system and controller work integrating the CVN-78 Ford Class carriers’ Dual-Band Radar.

April 10/13: FY 2014 Budget. The President releases a proposed budget at last, the latest in modern memory. The Senate and House were already working on budgets in his absence, but the Pentagon’s submission is actually important to proceedings going forward. See ongoing DID coverage.

“Missile integration with AMDR-S radar for DDG 51 Flight III ships will include requirements review/updates and analysis, verification; technical documentation, design review and working group SME support, missile/radar integration, missile test hardware procurement, risk assessment, safety, test and evaluation planning, analysis, data collection. Deliverables include interface specs and engineering documents to support AMDR PDRs HW&SW (FY13) and CDRs HW&SW (FY14); EDM testing (FY15), interface specs and engineering documents to support AMDR/ACBNext for DDG 51 Flight III E3 Testing, Analysis and Reports. Missile variants: ESSM Block I; SM-2 Blk IIIB MU2, SM-6 Block I (Current Aegis Configuration).”

Meanwhile, the Cooperative Engagement Capability program plans to spend 2013 working on interfaces that will let it work with AMDR. The Standard and ESSM programs will have related items on their plate, and Flight III destroyers will gain an interesting benefit from a discontinued carrier program. The AN/SPS-74(V) CVN Periscope Detection Radar program was canceled on Dec 17/12, with FY 2012 – 2013 funding directed to develop the algorithms and interface for the AN/SPQ-9B Radar instead.

March 28/13: GAO Report. The US GAO tables its “Assessments of Selected Weapon Programs“. Which is actually a review for 2012, plus time to compile and publish. Its AMDR section gives a program cost of $6.57 billion total to develop & buy 22 radars. As one might imagine when comparing to last year’s report (q.v. March 30/12), the program’s $9.24 billion cost drop heralds some major shifts in the program.

Instead of using AMDR-X radars, the first 12 AMDR systems will use Northrop Grumman’s existing SPQ-9B radar as their X-band component. According to the Navy, the SPQ-9B radar fits better within the Flight III DDG 51’s sea frame, and “expected power and cooling.” That’s no surprise, given that the “Spook-9” is already set to operate beside the S-band SPY-1D radar on Australia’s smaller Hobart Class destroyers. The bad news is that additional software work will be required to integrate a 2nd radar (SPQ-9B) with the new active S-band radar. AMDR was already on the hook for about 1 million lines of developed code, and software development has bent quite a few DoD project schedules.

The Navy will also have to compromise on radar performance in several areas. The Navy has now settled on a forced scale-down from the 20-foot aperture needed to meet their AMDR specifications, to a 14-foot aperture that’s the largest they can safely fit in the DDG-51 design. On the X-band front, SPQ-9B will eventually be replaced by a new X-band design for the last 10 units (13 – 22), but until AMDR-X arrives, the system won’t perform as well in X-band against the most advanced threats.

Major program shifts

Nov 26/12: NGC. Northrop Grumman announces that their AMDR technology demonstration contract is done. The firm says that they achieved both contract objectives: demonstrating that the critical technology is mature, and advancing the design of the tactical system. Northrop Grumman also successfully completed far field range testing of the AMDR-TD prototype, which reportedly met performance goals and radiated at top power for all waveforms.

FY 2011 – 2012

Functional reviews from contenders. RFP proposals in.

Sept 10/12: NGC. Northrop Grumman announces that its AMDR prototype has successfully completed initial range testing. Near Field Range testing validated the AMDR’s digital beam forming performance, tuning techniques, and reliability. Subsequent Far Field Range testing at Northrop Grumman’s radar test site in Baltimore, MD included successful full-power operational demonstrations.

July 31/12: RFP Proposals in. Lockheed Martin announces that it has submitted its “AMDR-S” proposal. Northrop Grumman and Raytheon both confirmed to DID that they also submitted proposals. Lockheed Martin.

April 2/12: NGC. Northrop Grumman announces that they’ve successfully finished AMDR’s System Functional Review (SFR) in late December 2011, and Test Readiness Review (TRR) “several weeks later”. SFR is a multi-disciplined technical review conducted to ensure that the system under review is technically mature enough to proceed into preliminary design. TRR assesses the readiness of the system for testing configuration items.

During the SFR, Northrop Grumman demonstrated digital beamforming and advanced tactical software modes, using its pathfinder early testing radar with a prototype radar suite controller to successfully detect and track airborne targets.

March 30/12: GAO Report. The US GAO tables its “Assessments of Selected Weapon Programs” for 2011. AMDR is scheduled to enter system development in October 2012, and the current program envisions $15.837 billion to develop and field 24 radar sets on DDG-51 Flight III destroyers.

Program officials believe that digital beamforming in a radar of AMDR’s size will be the most significant technical challenge, and will likely take the longest time to mature. Unfortunately, that technology is necessary for AMDR’s simultaneous air and ballistic missile defense mission. Meanwhile, a 14-foot version of AMDR-S is the largest radar they can safely fit within the DDG-51 destroyer’s deckhouse, even though it would take a 20-foot diameter aperture to fully meet all of the Navy’s specifications. The Navy is still discussing the precise size for AMDR-S in Flight III ships, and the design is supposed to be scalable up or down in size to fit on smaller or larger ships.

Nov 16/11: Power problem. Jane’s Navy International is reporting that DDG-51 flight III destroyers with the new AMDR radar and hybrid propulsion drives could cost $3-4 billion each.

If that is true, it’s about the same cost as a DDG-1000 Zumwalt Class ship, in return for less performance, more vulnerability, and less future upgrade space. AMDR isn’t a final design yet, so it’s still worthwhile to ask what it could cost to give the Flight IIIs’ radar and combat systems ballistic missile defense capabilities – R&D for the function doesn’t go away when it’s rolled into a separate program. Indeed, if the Flight III cost estimate is true, it raises the question of why that would be a worthwhile use of funds, and re-opens the issue of whether continuing DDG-1000 production and upgrades might make more sense. DoD Buzz.

Sept 19/11: Raytheon. Raytheon touts the performance of its Gallium Nitride AMDR T/R modules, which demonstrated no degradation after more than 1,000 hours of testing. Raytheon is developing a technology demonstrator for the system’s S-band radar and radar suite controller, and says that their testing figures exceed Navy requirements.

June 12/11: Growth problems? Aviation Week reports that AMDR’s key platform may be hitting growth problems. Power, cooling, and weight distribution have always been seen as the most likely stumbling blocks to fitting AMDR on the DDG-51 hull, and:

“As the possible requirements and expectations continue to grow for the proposed DDG-51 Arleigh Burke-class Flight III destroyers, so is the concern among defense analysts and contractors that the U.S. Navy may once again be trying to pack too much into one ship… And yet it is the need to field [AMDR] that is driving some of the additional requirements for the Flight IIIs… “Sometimes we get caught up in the glamour of the high technology,” Huntington Ingalls Industries CEO Mike Petters says. “The radars get bounced around. They get changed. Their missions get changed. The technology changes. The challenge is if you let the radars drive the ships, you might not get any ships built.”

June 7/11: Raytheon. Raytheon announces that it has conducted a system requirements review (SRR) for AMDR Phase II beginning May 17/11. Their release does not describe it as successful, offering only the less categorical claim that the “Navy’s feedback throughout the review was favorable,” and pointing out that the firm “matured its design ahead of schedule, surpassing customer expectations.” DID asked Raytheon about this. They said the review was successful, but they wanted to different phrasing for a change.

Raytheon is currently developing a technology demonstrator for AMDR’s S-band radar and radar suite controller, and the firm demonstrated hardware from that pilot array during the review. The SRR also included Raytheon’s understanding of AMDR’s requirements, how its design and architecture meets those requirements, and Raytheon’s its analysis of those requirements, including cost and performance trade studies. A System Functional Review will be held later in 2011.

June 1/11: AMDR Issues. An Aviation Week article looks at AMDR, and adds some cost estimates and perspective on the program.

“AMDR is the brass ring for Navy radar programs… Capt. Doug Small, program officer for Naval Sea Systems Command (Navsea), [says that] “We’re working hard to balance a tough set of requirements for this radar with its costs… BMD (Ballistic Missile Defense) targets drive radar sensitivity. There’s no substitute for having detect-and-track [capability] at a long distance… [But] To do simultaneous air defense [and BMD], you have to spend less time doing air defense. It’s a radar resource issue… [Fortunately,] The ability to create multiple beams digitally [digital beamforming] means you spend less time doing certain other functions.” “

The article adds that Lockheed Martin demonstrated S-band digital phased-array antenna beam forming during recent NAVSEA tests of the Advanced Radar Technology Integrated System Test-bed, which combines multifunction S-band active phased-array radars. It’s a joint U.S.-U.K. radar effort spearheaded by Lockheed Martin and BAE Systems, and Lockheed Martin’s VP naval radar programs, Brad Hicks, says the technology is now ready to enter full engineering development.

May 19/11: Raytheon. Raytheon announces that it has produced the first group of S-band transmit/receive (T/R) modules for the U.S. Navy’s AMDR program.

FY 2009 – 2010

Initial studies, tech development contracts.

Sept 30/10: US Naval Sea Systems Command in Washington Navy Yard, DC solicits bids via the Federal Business Opportunities website, receives 3 offers, and issues 3 technology development contracts for the AMDR S-band radar and its radar suite controller (RSC). AMDR-S will provide volume search, tracking, ballistic missile defense discrimination and missile communications. The RSC will perform all coordination actions to ensure that both radars work together. This approach dovetails with the Pentagon’s focus on competitive prototypes, as a way of reducing long-term risks of failed development and cost overruns.

Raytheon Integrated Defense Systems in Sudbury, MA received a $112.3 million fixed-price incentive (firm target) contract. Work will be performed in Sudbury, MA (81%), Fairfax, VA (18.3%), and New York, NY (0.7%), and is expected to be complete by September 2012 (N00024-10-C-5340). See also Raytheon.

Lockheed Martin Mission Systems and Sensors in Moorestown, NJ receives a $119.2 million fixed-price incentive (firm target) contract. Work will be performed in Moorestown, NJ (86.2%); Clearwater, FL (5.5%); Fairfax, VA (3.5%); New Brighton, MN (2.5%); Clearfield, UT (1.3%); and Huntsville, AL (1%), and is expected to be complete by September 2012 (N00024-10-C-5358). See also Lockheed Martin.

Northrop Grumman Electronic Systems in Linthicum Heights, MD receives a $120 million fixed-price incentive (firm target) contract. This contract is incrementally funded, with $38.4 million placed on the contract at the time of award. Work will be performed in Linthicum Heights, MD (99.4%), and Arvonia, VA (0.6%), and is expected to be complete by September 2012 (N00024-10-C-5359). See also Northrop Grumman.

Tech development contracts

Aug 10/10: An opinion from the Information Dissemination article Happy Thoughts and DDG-1000:

“I love Chris, and I don’t think anyone in the Navy deserved their star more than Jim Syring… but this Navy Times article is just a bit too much happy half-the-story for me. Here is how half the story gets told… The real reason the Navy is dropping the VSR on DDG-1000 is because the Navy intends to put… AMDR on the DDG-1000… because the timeline works out. The thing is the Navy can’t actually say this because there is no official AMDR program yet and the DDG-1000 isn’t supposed to be a ballistic missile defense ship – remember? This story in Navy Times is what it is because when it comes to US Navy shipbuilding, the Navy under CNO Roughead is never completely honest with the American people about what the Navy is doing. Sorry if the truth hurts.”

June 2/10: DDG 1000 loses DBR. As expected, the Pentagon this week certifies that the DDG-1000 destroyer program is vital to national security, and must not be terminated, despite R&D loaded per-ship cost increases that put it over Nunn-McCurdy’s legislated limit. There will be at least one important change, however: the S-band SPY-4 Volume Search Radar will be deleted from the DDG-1000’s DBR.

Performance has met expectations, but cost increases reportedly forced the Navy into a cost/benefit decision. The Navy would not release numbers, but reports indicate possible savings of $100-200 million for each of the planned 3 ships. The X-band SPY-3 has reportedly exceeded technical expectations, and will receive upgrades to give it better volume search capability. The move will save weight and space by removing SPY-4 aperture, power, and cooling systems, and may create an opportunity for Raytheon’s SPY-3 to be upgraded for ballistic missile defense – or replaced by the winner of the BMD-capable AMDR dual-band radar competition.

The full DBR will be retained on the USS Gerald R. Ford [CVN 78] aircraft carrier, as the SPY-4 replaces 2 air search radars and will be the primary air traffic control radar. No decision has been made for CVN 79 onward, however, and AMDR’s potential scalability may make it attractive there as well. Gannett’s Navy Times | US DoD.

No DBR on DDG-1000

Feb 26/10: CRS Report. The US Congressional Research Service lays out what remains of AMDR’s opportunity, in an updated report. From “Navy DDG-51 and DDG-1000 Destroyer Programs: Background and Issues for Congress” :

“The Navy’s FY2011 budget submission calls for procuring two DDG-51s in FY2011 and six more in FY2012-FY2015. The two DDG-51s that the Navy wants to procure in FY2011 received $577.2 million in FY2010 advance procurement funding. The Navy’s proposed FY2011 budget requests another $2,922.2 million in procurement funding for the two ships, so as to complete their estimated combined procurement cost of $3,499.2 million. The Navy’s proposed FY2011 budget also requests $48.0 million in advance procurement funding for the one DDG-51 that the Navy wants to procure in FY2012, and $186.3 million in procurement funding for DDG-1000 program-completion costs. The Navy’s FY2011 budget also proposes terminating the Navy’s planned CG (X) cruiser program as unaffordable. Rather than starting to procure CG (X)s around FY2017, as the Navy had previously envisaged, the Navy is proposing to build an improved version of the DDG-51, called the Flight III version, starting in FY2016. Navy plans thus call for procuring the current version of the DDG-51, called the Flight IIA version, in FY2010-FY2015, followed by procurement of Flight III DDG-51s starting in FY2016. Navy plans appear to call for procuring Flight III DDG- 51s through at least FY2022, and perhaps until FY2031. Flight III DDG-51s are to carry a smaller version of the new Air and Missile Defense Radar (AMDR) that was to be carried by the CG (X). The Navy’s proposed FY2011 budget requests $228.4 million in research and development funding for the AMDR. Detailed design work on the Flight III DDG-51 reportedly is to begin in FY2012 or FY2013.”

June 26/09: The Naval Sea Systems Command in Washington, DC issues 3 firm fixed-price contracts, covering initial concept studies for the (AMDR) S-band and Radar Suite Controller (RSC) only. Deliverables will include the S-band and radar suite controller conceptual design, systems engineering studies and analyses, and a technology development plan. This contract was competitively procured via the Federal Business Opportunities and Navy Electronic Commerce Online websites, with 3 offers received.

Northrop Grumman receives a $10 million contract. Work will be performed in Linthicum Heights, MD, and is expected to be complete by December 2009 (N00024-09-C-5398). See also NGC’s July 28/09 release.

Lockheed Martin Maritime Systems and Sensors in Moorestown, NJ, receives a $10 million contract. Work will be performed in Moorestown, NJ, and is expected to be complete by December 2009 (N00024-09-C-5312). See also Lockheed Martin’s July 14/09 release.

Raytheon Integrated Defense Systems in Sudbury, MA receives a $9.9 million contract. Work will be performed in Sudbury, MA (94%); Fairfax, VA (4%); Bath, ME (3%); Andover, MA (3%); Tewksbury, MA (3%); and East Syracuse, NY (2%), and is expected to be complete by December 2009 (N00024-09-C-5313). See also Raytheon’s Aug 3/09 release.

Initial studies contracts

Additional Readings

Background: AMDR

* FBO.gov (# N0002412R5315) – 58 – Synopsis for the AMDR-S/RSC Engineering and Manufacturing Development Contract with LRIP Options. Issued April 16/12, last modification May 14/13.

* USN Electronic Commerce Online – N00024-12-R-5315 AMDR EMD Solicitation.

* GlobalSecurity.org – Solid State SPY Radar/ Air and Missile Defense Radar (AMDR)/ Air & Missile Defense Radar (A&MD Radar)/ Next-Generation Maritime Air & Missile Defense/ Multi-Function Advanced Active Phased-Array Radar.

* Raytheon – Air and Missile Defense Radar (AMDR). Winner.

* Lockheed Martin feature, via WayBack – Lockheed Martin selected to demonstrate designs for next phase of Navy’s Air and Missile Defense Radar program.

* Northrop Grumman, via WayBack – Northrop Grumman Air & Missile Defense Radar (AMDR).

Background: Related Systems

* US Navy – AN/SPQ-9B Radar Set. AMDR’s initial X-band counterpart.

* DID – BMD in Bunches: The USN’s Multi-Year Destroyer Contract, FY 2013 – 2017. The contract includes options for AMDR-equipped destroyers in FY 2016 and FY 2017.

* DID – US Destroyers Get a HED: More Power to Them! Hybrid-Electric drive modifications might be needed, in order to solve the class’ power problems.

Official Reports

* US Congressional Research Services – Navy DDG-1000 and DDG-51 Destroyer Programs: Background, Oversight Issues, and Options for Congress. April 8/14 update.

* US Congressional Budget Office (Oct 18/13) – An Analysis of the Navy’s Fiscal Year 2014 Shipbuilding Plan.

News & Views

* Aviation Week (June 12/11) – Potential DDG-51 Flight III Growth Alarms. Could have strong implications for AMDR.

* Aviation Week (June 1/11) – AMDR program sets big goals.

* Military & Aerospace Electronics (June 29/09) – Next-generation missile defense radar systems for Navy warships is goal of new study contracts

* Defense News (Feb 2/09) – New Destroyer Emerges in U.S. Plans: Options Mulled As DDG 1000 Hits $6 Billion [dead link]. Includes AMDR coverage.

* DID Spotlight – The US Navy’s Dual Band Radars. Covers the SPY-3/VSR combination aboard the new DDG-1000 Zumwalt class destroyers and CVN-78 Gerald R. Ford class aircraft carriers.